Have you factored inflation into your insurance?

As we’re all well aware, inflation is rapidly increasing. The cost of living is far higher than anyone expected, and if history is anything to go by, prices will continue to rise.

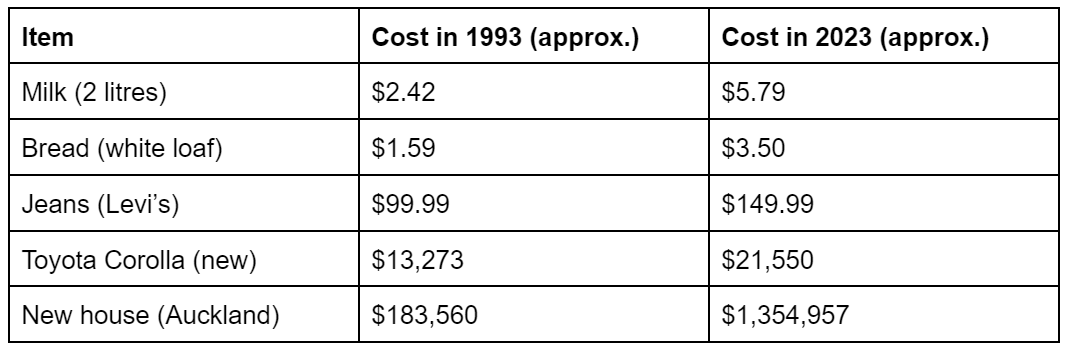

To give you an idea of just how much prices have changed with inflation, we’ve put together some remarkable price comparisons.

As you can see, the cost of everything goes up with inflation, especially house prices (that’s a staggering difference!)

Knowing that costs are always increasing, is your insurance cover enough to keep up? If you took out insurance on your home a decade ago and haven’t reviewed it since, you might be in danger of losing out should you need to make a claim.

This is because the sum insured you specified when first taking out your house insurance might not cover the total cost of rebuilding in 2023. Although insurers usually adjust your sum insured at renewal time to try to take inflation into account, increases are happening much faster than can be accounted for.

If you think about the insurance policies you may have, including vehicle and contents cover, is the amount you’re covered for in line with today’s values? If you needed to replace an asset or item right now, would you be able to purchase the same asset with your current cover?

It’s also important to also factor in any personal cover you have. If your earnings have increased, have you also increased your income protection? Is your mortgage repayment insurance enough to cover your current mortgage payments? What about your life cover and trauma cover, have you reviewed them to make sure that they are sufficient?

These are questions you should be asking yourself regularly, and the only way to ensure that you’re 100% covered when the unexpected happens is to review your insurance policies often.

Taking the time to sit down with the professionals to review your cover is essential, especially in times of high rates of inflation, and increased living costs. If you’d like to sit down and have a free, no-obligation chat with our team about your insurances, click below to get in touch - we’ll help you get it right!