Health comes first - Findings from the FSC’s latest ‘Money and You’ report

The Financial Services Council (FSC) recently released their latest research report, ‘Money and You - Taking Cover.’ Surveying over 2,000 Kiwis, their study reveals some interesting insights into the financial wellbeing of New Zealanders and their relationship with insurance.

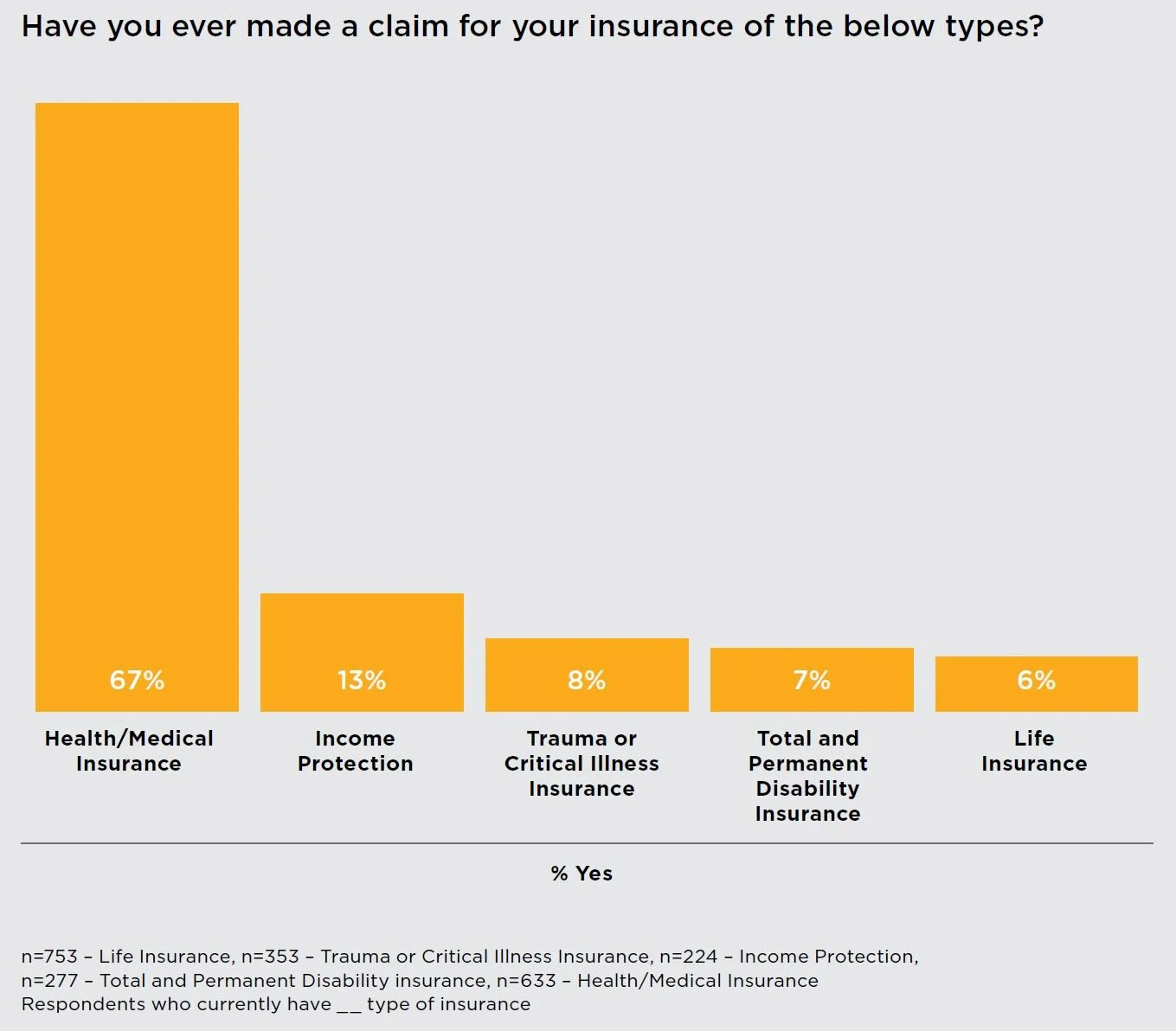

It was discovered that of all of the life and health solutions that are put in place to protect New Zealanders, health insurance is by far the cover that is the most claimed on. When asked, ‘Have you ever made a claim for your insurance of the below types?’ Health/Medical Insurance led the way with a whopping 67% of participants voting Yes.

It was discovered that of all of the life and health solutions that are put in place to protect New Zealanders, health insurance is by far the cover that is the most claimed on. When asked, ‘Have you ever made a claim for your insurance of the below types?’ Health/Medical Insurance led the way with a whopping 67% of participants voting Yes.

The survey also reported that almost 70% of New Zealanders don’t have health insurance, leaving them to rely on an overwhelmed and understaffed public health system. So why is it that these Kiwis don’t have health insurance in place?

When asked this question in the survey, over half of the participants stated that cost was a major barrier to taking out insurance, with 55% saying they would get cover if they had more money. And who can blame them, with the continued increase in living costs?

The issue however, is with the long-term effects of being underinsured. FSC CEO Richard Klipin explains, “While it’s understandable some are, and should be, prioritising immediate needs, the latest findings are cause for alarm and reflect the importance of long-term thinking when it comes to our finances.”

Given that the FSC report also found that 40% of Kiwis would be unable to access $5,000 if something unexpected were to happen, Klipin also states, “We need to consider what would happen if you suddenly got sick or had an accident and were unable to earn a living. If you don't have access to emergency funds and don't have insurance, who else will be impacted and is relying on you to get by?”

Of course your current financial situation might seem tough, and getting insurance is often pushed further and further down the priority list. But Klipin is right - we need to be thinking about the long-term. If something happens to you down the track, you’ll be in an even worse position financially if you don’t have the right cover in place.

Say you need to access urgent healthcare or treatment that’s not funded, or you have dependents who you couldn’t provide for if you were unable to work. A little bit of long-term thinking now goes a long way later.

If you know you should get some health insurance sorted but you're worried about how it will impact your budget, sit down with one of our friendly advisers for a free, no-obligation chat.

We’re here to help you keep you and your family protected, but we’re also people too. We know that life often gets in the way, and it isn’t always easy to keep up with rising costs. We’ll look at your current financial situation and recommend a policy that will suit your needs, as well as your budget, so you can rest assured you’ve got cover that works when you need it.